Source: informationclearinghouse.info

August 04, 2018 "Information Clearing House" - We are supposedly seven years into a “recovery” from the global economic collapse that commenced in 2008. The latest evidence offered to promote this oft-peddled mantra is that U.S. gross domestic product showed a strong uptick for the second quarter of 2018, an annualized rate of 4.1 percent, nearly double that of the first quarter.

Coupled with the ongoing decline in unemployment (although standard unemployment rates greatly underestimate the true rate of employment), orthodox economists, conservative propagandists and apologists for the Trump administration would have use believe happy days are here again.

So why aren’t our wages increasing?

In part, it is because the true unemployment rate is not nearly so low as the “official” unemployment rate used by governments around the world, and thus the ranks of unemployed and underemployed are sufficiently large that there is no upward pressure on wages. Orthodox economists, dedicated as they are to ignoring any evidence that doesn’t match their models designed to “prove” that all manners of capitalist excess are as natural as the tides of the ocean — and thus in practice the professional wing of conservative propagandists — have various excuses for stagnant wages and ever increasing inequality. A favorite among these is an alleged “skills mismatch” — too many unskilled workers and a shortage of skilled workers for the high-tech jobs of today.

|

Are You Tired Of The Lies And Non-Stop Propaganda?

|

The data tells a different story, however. A 2014 report by the National Employment Law Project found that low-wage jobs were created at a faster pace than higher-paid jobs were lost in the first years to that point. The Project reported this breakdown:

- Lower-wage industries ($9.48 per hour to $13.33) constituted 22 percent of the 2008-2010 losses, but 44 percent of jobs gained since then.

- Mid-wage industries ($13.73 to $20.00) constituted 37 percent of the 2008-2010 losses, but 26 percent of jobs gained since then.

- Higher-wage industries ($20.03 to $32.62) constituted 41 percent of the 2008-2010 losses, but 30 percent of jobs gained since then.

Moreover, an Economic Policy Institute study at the time found that those among the two categories of “some college” and holders of four-year college degrees showed the highest increases in long-term unemployment.

Imbalance in power forces down wages

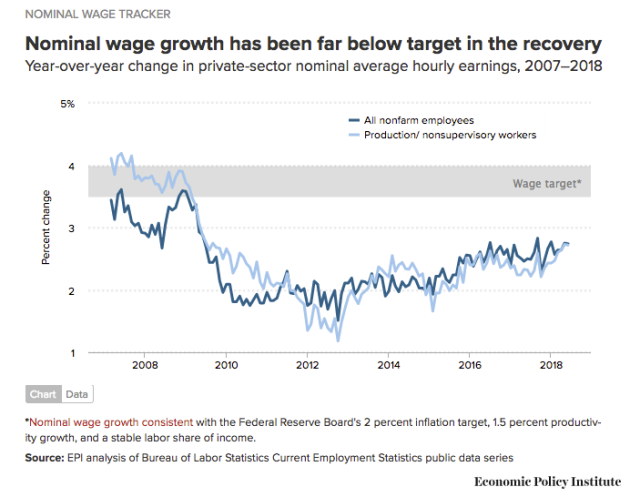

The situation has not changed significantly since. A July 2018 commentary by the Economic Policy Institute, written by Heidi Shierholz and Elise Gould, notes that wages remain stagnant even though more recently middle- and high-wage jobs are being added at strong proportions than low-wage jobs. This development means that there is now upward pressure on wages, they write.

Yet wages clearly are not rising. How to account for this disparity? Dr. Shierholz and Dr. Gould argue that the increasing power of employers over employees is counteracting that upward pressure to instead depresses wages:

“What is most likely happening is that worker leverage and bargaining power have been so decimated by policy choices—policy choices that have, for example, led to the erosion of union coverage and labor standards like the minimum wage—that for tight labor markets to spark upward wage pressure the economy requires a much lower unemployment rate now than it did in the past.”

If there really were a shortage of skilled workers, the two economists wrotein a separate commentary, there would be faster wage growth because employers would need to offer higher wages to attract the limited pool of candidates. Therefore,

“Since we continue to see anemic average wage growth, not just slow wage growth for select groups of workers, it’s clear that there is not a widespread shortage of the types of workers (i.e., those with the right skills) that employers need.”

Compounding this situation is that the ongoing merger mania means that fewer corporations control the labor market. In other words, there are more industries in which a small number of companies have “monopsony power.” (A single or very limited number of sellers possess a monopoly; a single or very limited number of buyers constitutes a monopsony.) Dr. Shierholz and Dr. Gould explain that monopsony employers are able to pay less. They wrote:

“When firms have monopsony power, they are able to pay workers less than what their work is ‘worth,’ i.e. less than their marginal product. But a key dynamic of monopsony power is that even though monopsonists would like to hire more workers, the low wages they offer mean they can’t attract more workers unless they pay more. That is, it is a normal state of affairs for a firm with monopsony power to wish they could hire more workers at the wages they are offering, but to be unable to attract additional workers because their wages are too low. So when a firm with the power to set wages below a workers’ marginal product complains about not being able to find workers at the wages they are offering, it’s useful to remember that they are choosing to keep wages low in order to increase profits—which remain high as a share of corporate sector income—and could get more workers by simply raising wages. And importantly, when firms with monopsony power complain about not being able to find workers, it is not adequate evidence of a skills shortage.”

The inadequacy of gross domestic product

A look at numbers beyond gross domestic product reveal the true state of the economy. GDP, defined as “the sum of private consumption and investment and government spending (with account taken for foreign trade),” is increasingly seen as an inadequate measure. Even one of the leading voices of British finance capital, The Economist, criticizes GDP as a relic designed to measure economic output during World War II, terming it “A measure created when survival was at stake [that] took little notice of things such as depreciation of assets, or pollution of the environment, let alone finer human accomplishments.”

Similar criticisms have been offered by the International Monetary Fund, certainly no friend of working people. An IMF commentary admitted:

“The limit of GDP as a measure of economic welfare is that it records, largely, monetary transactions at their market prices. This measure does not include, for example, environmental externalities such as pollution or damage to species, since nobody pays a price for them. Nor does it incorporate changes in the value of assets, such as the depletion of resources or loss of biodiversity: GDP does not net these off the flow of transactions during the period it covers.”

Left unsaid by these standard-bearers of the establishment is that GDP pays no attention to inequality. If there is more wealth, but all that wealth is concentrated in a small number of hands while all others suffer declining living standards, then GDP will rise even though working people are worse off. And, as alluded to by The Economist and the IMF, a degradation in the environment could cause a spike in GDP because some corporation will make money from a government contract to clean up the mess (paid for by taxpayers) at the same time that the corporation that caused the mess can offload that cost onto society, and thus enhance its profitability.

A one-time boost to GDP, such as the United States reported for the second quarter of 2018, doesn’t necessarily signify anything. That boost is likely the product of factors that won’t repeat, some observers have already said. A July 27 commentary published by the online financial news service MarketWatch had no trouble debunking the nonsense spewed by Trump administration advisers Kevin Hassett and Larry Kudlow. For example, in countering the claim that the U.S. trade deficit has narrowed because Trump is “standing up for America,” the MarketWatch commentary noted:

“Exports of agricultural products like soybeans shot higher because farmers were racing to beat the imposition of Chinese tariffs. They already fell in June. There’s absolutely no evidence the U.S. is now trading on better terms than previously.”

It’s not only your wages that aren’t keeping up

If a better measure of economic well-being is wages, then there has been no improvement. Adjusted for inflation, the U.S. Bureau of Labor Statistics reports that the country’s average weekly wage was $930.81 for June 2018, a grand total of 47 cents better than June 2017. Considering that the rate of inflation was higher than the microscopic increase in wages over the past year, adjusted for inflation U.S. workers actually saw a slight decline over the past year. So happy days really aren’t here after all. It’s not only you.

This is a continuation of a decades-long pattern. Wages have been stagnant since the 1970s despite strong increases in worker productivity — the average U.S. household earns hundreds of dollars less than it would had wages kept pace with productivity. The same is true for Canadian households.

When adjusted for inflation, Statistics Canada reports that real wage growth for Canadian workers increased less than one percent per year from 2005 to 2015. That’s nothing new. “While Canada has undergone important economic, social and technological changes since the 1970s, the minimum wage and the average hourly wage are essentially unchanged,” Statistics Canada reports. Accounting for inflation, the Canadian minimum wage peaked in 1976 and average hourly earnings peaked in 1977. That is despite a consistent increase in Canadians earning degrees. So a “skills mismatch” would not seem to be a reality there, either.

The gap between labor productivity and median real hourly wages growth, 1986-2013 (percentage points per year)

Those trends are not limited to North America. British wages actually contracted between 2007 and 2015 despite a growing economy. Britain’s GDP is almost 10 percent higher now than at the bottom of the 2008 economic crash, yet wages have declined. Wages have not kept up with productivity across Europe, and in some countries haven’t kept up with inflation, meaning workers have seen de facto wage cuts. The most recent study on this topic, studying the balance between wages and productivity in 11 advanced-capitalist countries from 1986 to 2013, found that wages did not keep pace in eight of them, with the widest lag found in the United States. Germany was second.

Unfortunately these reports, although doing a fine job of quantifying how screwed we are, tend to conclude with pleas for better government policies. Surely there should be. But although positive reforms would be welcome, the problem is that reforms can, and are, taken away when mobilizations fade. The hyper-competitive nature of capitalism, under which our labor is a commodity, can’t be altered; at best through massive effort reforms can be achieved until the next wave of attacks commences. As long we continue to fail to question the world economic system, our conditions will only worsen.

Pete Dolack, is an activist, writer, poet and photographer. Pete is the author of the book It’s Not Over: Learning from the Socialist Experimenthttps://systemicdisorder.wordpress.com

RELATED:

Americans Live In A World Of Lies |